Like millions of homeowners you’ve probably only learned about the need for home insurance days before closing. Your aunt Sally recommends someone quickly, and you’re sent a ream of documents to review and sign without much time to consider each point carefully. For many buyers, home insurance was merely paperwork to satisfy your mortgage lender. However, it’s actually quite important to consider the nuances of your home insurance policy which can have a very costly impact on your finances in the event of an accident. A homeowners insurance helps to alleviate the burden of potential damages, losses, and liabilities associated with your property. Here are 7 key points to consider when shopping for yours.

Property Coverage

Your property coverage should be listed at the very top of your policy. This section outlines coverage for your dwelling, personal properties, and loss of use. Your dwelling is simply the physical structure of your home, any fixtures and improvements on your land. Personal properties such as your TV, laptops, jewelry may be included in your coverage as well. Typical property insurance may not provide full coverage for high-value personal items such as jewelry so you may want to purchase additional insurance or find other ways to keep your items safe (ex. bank safe). Lastly, your policy should provide reimbursement for any loss of use of the property. For example, your insurance may pay for temporary housing while your property is being repaired or rebuilt.

Liability

Beyond basic property coverage, your home insurance should also include liability coverage. This is designed to cover the cost of lawsuits and damages that may occur at your property. For example, if someone slips on a sheet of ice on your front step, then your liability coverage may cover the medical expenses, the legal fees, and other property damages.

Coverage (Inclusion / Exclusion)

A big misconception that new homebuyers have is on the scope of coverage. The typical insurance policy does not cover ALL ADVERSE events. If someone is hurt on your property because of your deliberate negligence, then the adjuster may be inclined to deny your reimbursement. So homeowners should not abandon their responsibilities to upkeep their homes. Beyond homeowner negligence, the typical home insurance also EXCLUDE certain adverse causes (perils) such as earthquakes, flooding, sewage backups, insect damage, deliberate damage to the home, and pollution. Most insurance policies however will INCLUDE perils such as fire, smoke, wind, explosions, theft, falling trees, ice and snow damages, damages from vehicles, water damage from ruptured pipes.

How much should you buy?

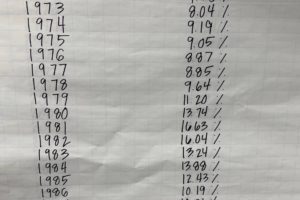

So just how much coverage should you buy? Afterall, your coverage is what will dictate your premium and you will ultimately want a policy that will cover the REPLACEMENT COST of your dwelling, personal possessions, and any associated liabilities. Your replacement cost is simply the cost to rebuild your home today. Your premium is also affected by the amount of liability coverage you wish to purchase. This includes coverage for personal injuries, legal fees, and other claims that may be brought against you as the policy holder. Many factors will determine your replacement cost and desired liability coverage. Factors such as the age of the property, the condition, the location, market value, size, and other amenities will influence your replacement cost, risk of liability, and ultimately your home insurance premium.

Reduce your premium

Getting proper insurance coverage is important as we’ve established. But that doesn’t mean you can’t take advantage of tricks to reduce your premium. After all, these are designed by insurers to incentivize good behaviors.

- Lower Replacement Cost: if the cost of replacing the property is lower, then the premium will be lower as well. It’s worth taking this into consideration when buying a home.

- High Liability Amenities: properties with a trampoline or a swimming pool will generally increase your premium as the risk of injury is considered significant.

- Pet Choices: Some insurers will not insure you If you have certain pets that are deemed aggressive such as pit bulls or rottweilers.

- Heating Systems: Wood furnaces or older oil tanks may also impact your insurance premium as well.

- Adjusting Your Deductibles: raising your deductibles will help reduce your premiums. Be aware that this will increase your out of pocket expenses should you file a claim.

- Upfront Payment – some insurers will give you a discount if you make your annual payments upfront rather than per month

- Lastly, reach out to a knowledgeable insurance agent who can walk you through ways to get the best rate for your coverage. Our team can also refer some excellent local insurance agents if you are in need of one.

Conclusion

Insurance is there to make a catastrophic event less painful financially. This is why it’s important for you to research your options and get multiple quotes. Asking the tough questions ahead of time will save you many sleepless nights down the road. Ultimately, it’s designed to give you a peace of mind.