The Fundamentals of Making Money in Real Estate

Sometime ago, I had the incredible opportunity to meet a friend (who will remain nameless) that I have not connected with for several years. He was driving through Boston for a business trip so we caught up.

Without getting too into the weeds, his story was one that we’ve all heard before. Prepubescent boy immigrates to America with no English, hustles through odd jobs and eventually worked to build a multi-million dollar fortune. While our discussion spanned across hours, I want to share one specific segment of our chat that touched on the fundamentals of Real Estate investing, specifically – how do people actually make money with Real Estate? At the very core, he outlined the following 4 ways:

1. Cash Flow

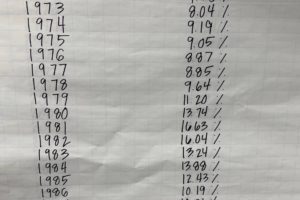

Cash is king and cash flow is perhaps one of the most critical metrics you should define before any investment. The mechanics of cash flow is simple: (Gross Rental Income) – (Financing + Operating Expenses). Assuming a fairly robust economic landscape, cash flow will remain stable. This is the core of passive income and the building blocks for infinite wealth (as Robert Kiyosaki had put it). Cash flow is generally better than other metrics such as Rent Multipliers but this will differ according to the investment criteria of the individual. Also recognize that your cash flow is always a projection so take into consideration time-dependent factors such as inflation and potential returns of comparable investments to get a present value of future cash flow (see Reference). Lastly, Multi-Unit/Family properties generally yield better cash flow than single family properties which tend to appreciate better so do recognize that there are trade offs.

2. Appreciation

Appreciation occurs when economic forces allow for properties and asset to increase in market value. From an investment standpoint, appreciation really is the icing on the cake. A simple example would be a duplex that was purchased for $100,000.00 and is appraised at $150,000.00 after 5 years. This can be a result of a new bus station or a park redevelopment project. One caveat to note is that appreciation should not include any major improvements or alterations. The real power behind appreciation is that it allows for the owner to leverage beyond the initial investment. In other words, a house that has appreciated $50,000.00 allows the owner to leverage a percentage of that amount for further investments or loans.

A mistake that most novice investors make is betting on the appreciation potential of their asset instead of running the numbers. The key is to make wise investment decisions NOT speculations.

3. Amortization

Amortization is traditionally defined as the distribution of your mortgage across multiple payments that include both your principal and interest. Most folks would consider this a cost but from an investment standpoint, this is contributing to your equity (just like appreciation). Equity is the difference between paying rent and mortgage. Your rent might be cheaper but that’s money that will not contribute to your equity. For the same reason that appreciation is great, equity provides you leverage to reinvest and grow.

This is even more powerful when you use OPM (other people’s money) to pay down your mortgage expenses. If you’re a renter, your money is being use to pay down someone else’s mortgage.

4. Tax Benefits

Tax Sheltering is complex topic that most people have some level of confusion about and should certainly consult with an accountant. The key point here is that U.S. Tax system is developed to direct the economy in a specific direction. Investments in areas such as renewable energy and local small businesses are often incentivized with major tax exemptions. Real Estate is an area with massive tax incentives which includes capital gains, deduction of operating expenses, and interest payments. Moreover the U.S. Tax system allows your to deduct any depreciation on your property (even as the property is appreciating in the market).

To sum it up, all investments carry risk and Real Estate is not an exception. My friend concluded our discussion with a few tokens of wisdom. Investing in Real Estate is still one of the dominant/attainable ways to build wealth (for the reasons outlined above). Most Real Estate Investors never succeed because they over-speculated or never established an investment team they can trust. Start investing in yourself and your relationships today because time is the engine that drives Passive Wealth.

Reference: What Every Real Estate Investor Needs to Know about Cash Flow – Frank Gallinelli